FRAUD DETECTION AND DETERRENCE

The best way to ensure that your business is protected and employees are not presented with temptation is to ensure that organizational controls are sound. No one likes to think that they are being taken advantage of. Business owners and managers are certainly no different. Many owners even think of their business and employees as their family, so to consider that a “family” member is cheating you is a dreaded thought. But one must remember that the only people who ever cheat you are those that you trust; otherwise, you wouldn’t have put them in a position in which they could have cheated you! Answer the following questions to judge your corporate exposure:

- Does your company perform internal audits on a regular basis?

- If not, are any resources dedicated to the regular review of processes?

- Have you done an assessment recently to ensure that your business is reasonably well controlled?

- Does your company understand that external audits are NOT designed to uncover fraud?

- Is there an attitude of healthy skepticism regarding fraud at your company?

- Has management promulgated a broad culture of internal control responsibility throughout the organization?

If you answered “no” to any of the above you may have an elevated risk of fraud in your company.

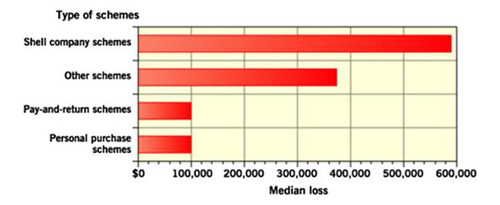

Example of Risk: Billing Schemes

Billing schemes represent by far the most expensive category of asset misappropriation. Companies of almost every type, size and industry are vulnerable. In billing schemes a company pays invoices an employee fraudulently submits to obtain payments he or she is not entitled to receive. There are four major types of such ploys…

Shell company schemes

Shell company schemes use a fake entity established by a dishonest employee to bill a company for goods or services it does not receive. The employee converts the payment to his or her own benefit.

Pass-through schemes

Pass-through schemes use a shell company established by an employee to purchase goods or services for the employer, which are then marked up and sold to the employer through the shell. The employee converts the mark-up to his or her own benefit.

Pay-and-return schemes

Pay-and-return schemes involve an employee purposely causing an overpayment to a legitimate vendor. When the vendor returns the overpayment to the company, the employee embezzles the refund.

Personal-purchase schemes

Personal-purchase schemes consist of an employee’s ordering personal merchandise and charging it to the company. In some instances, the crook keeps the merchandise; other times, he or she returns it for a cash refund.

Fraudulent Billing: It’s Not Small Change

![]()

Red Flags for Billing Schemes

- Invoices for unspecified consulting or other poorly defined services.

- Unfamiliar vendors.

- Vendors that have only a post-office-box address.

- Vendors with company names consisting only of initials. Many such companies are legitimate, but crooks commonly use this naming convention.

- Rapidly increasing purchases from one vendor.

- Vendor billings more than once a month.

- Vendor addresses that match employee addresses.

- Large billings broken into multiple smaller invoices, each of which is for an amount that will not attract attention.

- Internal control deficiencies such as allowing a person who processes payments to approve new vendors.